Practical considerations for miners shifting mindsets

Miners are looking to a future where the right to produce ore from a tenure is not a tenable path to prosperity. Not only do miners need to extract and process minerals faster than ever before, but they need to do it affordably, competitively, and above all, responsibly.

To move forward into this future, miners must move away from a ‘primary producer’ only mindset and start to think – and operate – with a circular economy mindset across the value chain, investing in growing the capacity to deliver commodities in multiple ways. There are three key pathways on the journey to consider: recycling, thrifting, and substitution.

Clareo’s Peter Bryant presented a keynote in the Mining, Metals and Circular Economy stream and chaired a plenary panel at IMARC 2024 in Sydney, focused on the disruption of metals and minerals that true circularity imposes. Collaboration along entire supply chains is a recurring theme, as miners move towards being ‘materials providers’.

Facing significant headwinds

Building circularity into a mining business is one of the best strategic responses that miners can contemplate in the midst of social, political, economic and fiscal headwinds. From resource nationalism and state-directed market shaping, to the growing technical challenges of extracting ore in difficult terrains and depths, through to the capital deficit, supply shocks and financial vulnerability (for non-majors particularly), the outlook looks somewhat bleak. But we see a path where companies can ride the headwinds to become valued development partners and materials providers for a just energy transition.

Building circularity ‘inside the fence’ and ‘outside the fence’

The IMARC plenary panel discussion entitled “Exploring the Role of Mining and Metals in the Circular Economy” highlighted ways that producers are starting to move forward to maximize the value of a given resource, with responsible sourcing partnerships and financial models to share the burden, encourage coordination and collaboration, creating stability and long-term profitability. This can happen in two ways: inside the fence and the boundaries of the mine site, and outside the fence to change the way miners interact with their supply chains.

Inside the fence

As Michelle Carey from IMDEX proposed during the plenary session, seeing the orebody as a whole and maximising the efficiency of a given deposit is a necessary circularity mindset. It starts with truly understanding the full extent of the deposit, then planning to waste nothing. Precision mining, with optimised processing using every viable technological improvement is key, as well as planning ahead to harvest and market every useable component in the deposit. A great example is Vale’s Brazil nickel operations who are partnering to convert 50ktpa of refinery slag per year into carbon-efficient fertilizers for nearby agriculture.

In another example, tailings dams and mine waste are some of the richest sources of rare earth elements but are often not considered an asset by miners. Switching to a circularity mindset demands a change of strategy. Upfront capital costs and past mistakes in waste materials on site can’t be reversed easily, if at all. But miners must now start to think of tailings as an opportunity for diversity and profitability, rather than an expensive liability to be managed and maintained. Making the most of waste is an important part of a mine’s social license to operate – the dynamics are complex, but demonstrating responsible stewardship of the entire orebody adds to the social permission to move forward on future projects.

Outside the fence

Recycling, thrifting and substitution are key pillars of materials circularity. Looking outside the fence to partner with recyclers, implement thrifting technology and experiment with substitution is new territory for many producers. Studying the experiences of other industries, such as the plastics industry, reveals an opportunity for miners to avoid reinventing the wheel. For example, plastics manufacturers now design production with the end of life of the item in mind, as they grapple with the unfortunate reality that recycling the vast tonnage of plastic already in circulation is practically impossible. If mining was to do this, it would involve a whole-of-value-chain effort to understand the end uses of its product and optimise for circularity.

Building circularity in the materials supply chain beyond the mine is possible, but it requires a mindset shift. Keeping the end-of-life of minerals and metals in mind from the start can only serve to build shareholder confidence, financial stability and long-term viability.

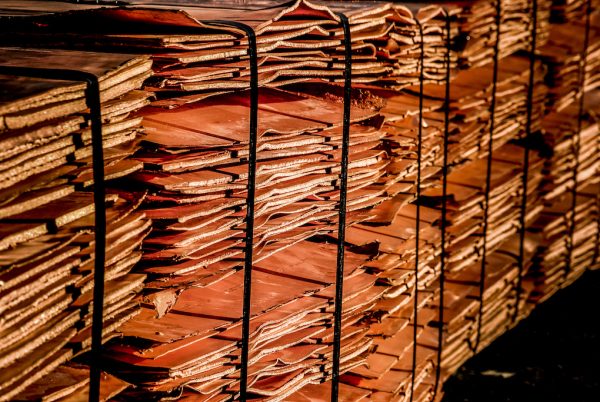

Already, there is progress in these areas, as steel, lead and copper recycling efforts are starting to build. We see multi-billion-dollar opportunities ahead for copper recycling particularly, given the copper famine fast approaching and the 85% energy differential between producing new copper and recycling scrap and the vast amount of copper scrap that is not recycled annually. Majors like Glencore are leading the way in partnering with recycling technologies, as demonstrated by their recent investment of $275M in Li-Cycle, a lithium-ion battery recycler.

Thrifting – using less of a metal or mineral in producing the same amount of energy – is also opening new avenues for future proofing materials providers. Between 2015 and 2030, for example, the amount of copper needed for each EV is forecasted to drop by 50% to near 38kg per car. While this is good news amidst predictions of a minerals famine, it could also represent a risk for demand predictions.

Substitution of metal components and content in our energy systems and end-user manufacturing can also reduce the pressure on materials providers, and as technology delivers innovative improvements, substitution strategies will also deliver benefits across the whole value chain. Consider the mineral contents of modern battery chemistry and new batteries like sodium-ion and solid state: since 2017, cobalt content has shrunk from above 60% to under 40%.

To achieve the vision of reimagining mining in a true circular economy will take collaboration, determination and technology that hasn’t yet been created or commercialized. It starts with a mindset change at the highest levels, permeating throughout a business, changing the culture and instituting a new approach to what it means to be a materials provider. And to make all this happen, we need inspiration and courageous leadership.